wichita ks sales tax rate 2019

The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. You can print a 75 sales tax table here.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Send change of address form to Kansas Register Secretary of State 1st Floor Memorial Hall 120 SW 10th Ave Topeka KS 66612-1594.

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

. Wichita collects the maximum legal local sales tax. State Sales Tax. KPIs 2019 Green Book an annual publication since 2014 shows this fact with spending and tax information for cities counties and states.

Wichita County Texas Official Tax Office Website. This is the case with the Wichita city tourism fee which took effect on January 1 2015. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law.

In 2019 it was 32721 based on the Sedgwick County Clerk. Income and Salaries for Wichita - The average income of a Wichita resident is 24921 a year. The most common methods of assessment are the square foot basis and the fractional basis.

The rates listed below include the state sales tax rate of 65. The US average is 46. The Rent Zestimate for this home is 689mo which has decreased by 14mo in the last 30 days.

Broadway Avenue as well as 212 221 and 223 E. Subaru of Wichita LLC. Periodicals postage paid at Topeka Kansas.

SALES TAX WH TAX INCOME RESPONSIBLE PARTY TAX TYPE. Mon-Fri 800am - 100pm 230pm - 430pm. 3 lower than the maximum sales tax in KS.

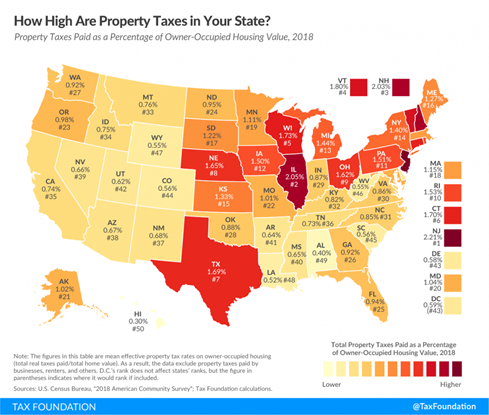

- Tax Rates can have a big impact when Comparing Cost of Living. This is the total of state county and city sales tax rates. The Lincoln Land Institute found that Iola KS has the highest rural property tax rate in the nation.

You can print a 75 sales tax table here. The County sales tax rate is. The Kansas sales tax rate is currently.

As well as continue the redevelopment of downtown Wichita. Single copies if available may be purchased for 2. 11610 East Kellogg Wichita KS 67207.

Tax Rates for Wichita - The Sales Tax Rate for Wichita is 75. The Zestimate for this house is 70200 which has increased by 1300 in the last 30 days. This tax of 275 is paid directly to the city 1 so it doesnt appear in KDOR figures.

Sales Tax Rate Down Payment Loan Term years Interest Rate Total Price. If the square foot basis is used each property owner will be responsible for a share of the project cost relative to the square footage of hisher lot. For tax rates in other cities see Puerto Rico sales taxes by city and county.

It also includes the City owned Chester Lewis Reflection Square Park and parking lot at William and Broadway. The minimum combined 2022 sales tax rate for Wichita Kansas is. Sales tax rates in sedgwick county are determined by twelve different tax jurisdictions derby kechi maize sedgwick county cheney bentley mulvane wichita park city haysville.

If the fractional basis is used each lot in. For additional details including jurisdiction codes see the Kansas Department of Revenue. In some cases jurisdictions may levy additional taxes that may not be paid to the Kansas Department of Revenue.

- The Income Tax Rate for Wichita is 57. In 2018 the percentage of US citizens in Wichita KS was 936 meaning that the rate of citizenship has been increasing. Sales Taxes Amount Rate Wichita KS.

The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax. Depending on the zipcode the sales tax rate of wichita may vary from 62 to 75 depending on the zipcode the sales tax rate of wichita may vary from 62 to 75 Wichita ks sales tax rate 2019. There is no applicable city tax or special tax.

The Wichita sales tax rate is. Kansas sales tax changes effective July 1 2019 New sales and use tax rates take effect in the following cities counties and special jurisdictions on July 1 2019. The 2 sales tax will be distributed on a.

Standard deduction one exemption - Sales Tax includes food and services where applicable. State Income Taxes. With local taxes the total.

31 rows The state sales tax rate in Kansas is 6500. In Wichita the rate is six percent. Thats an increase of 1431 mills or 457 percent since 1994.

The US average is 73. Therefore larger lots will pay more than smaller lots. It contains 2 bedrooms and 0 bathroom.

Total of Term Payments. Get the latest property info at RealtyTrac. Vehicle Property Tax Estimator.

Buildings at 105 and 124 S. 2019 N Jackson Ave Wichita KS is a multi family home that contains 1218 sq ft and was built in 1920. These are for taxes levied by the City of Wichita only and do not include any overlapping jurisdictions Wichita mill levy rates.

The Tax Office mission is to make the paying of ad valorem property taxes and licensing and titling of vehicles easy efficient and cost effective for the citizens of Wichita County. By contrast there is a consistent finding that higher economic performance follows lower taxes. Scriptions are 80 Kansas residents must include applicable state and local sales tax.

As of 2019 946 of Wichita KS residents were US citizens which is higher than the national average of 934. On March 26 2019 the Kansas Senate confirmed Mark Burghart as the Secretary of Revenue. This used GMC car is priced at 34934 and available for a test drive at Subaru of Wichita LLC.

Used 2019 GMC Acadia SLE for sale in Wichita KS. For tax rates in other cities see Kansas sales taxes by city and county. The US average is 28555 a year.

Discover 1153 FARMSTEAD ST WICHITA KS 67208 -- Residential property with 1872 sq. Ft 5 beds 3 baths. The Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984.

Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. Wichita KS 67218 Email Sedgwick County Tag Office. Resident will owe Kansas use tax of 895 current Anytown rate on the total charge of 2000 when that resident brings the laptop computer back to Anytown KS.

There is no applicable city tax or special tax.

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Kansas Is One Of The Least Tax Friendly States In The Us Kake

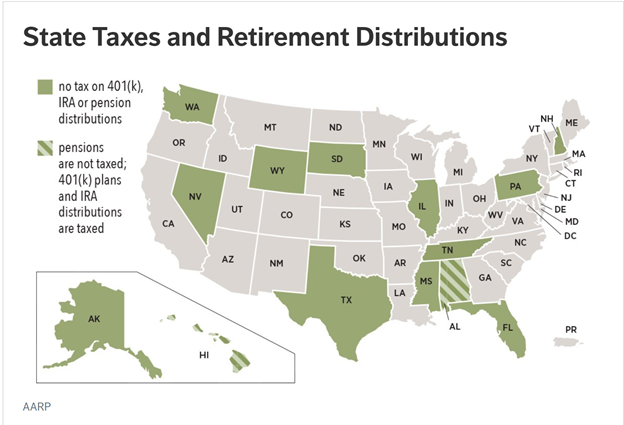

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Kansas Income Tax Brackets 2020

Kansas Income Tax Calculator Smartasset

Kelly Recommending One Time 445 Million Tax Rebate To 1 2 Million Kansas Taxpayers Kansas Reflector

Tax Council Testimony Kansas Sales Tax Burden Creates Regressive System Kansas Reflector

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute